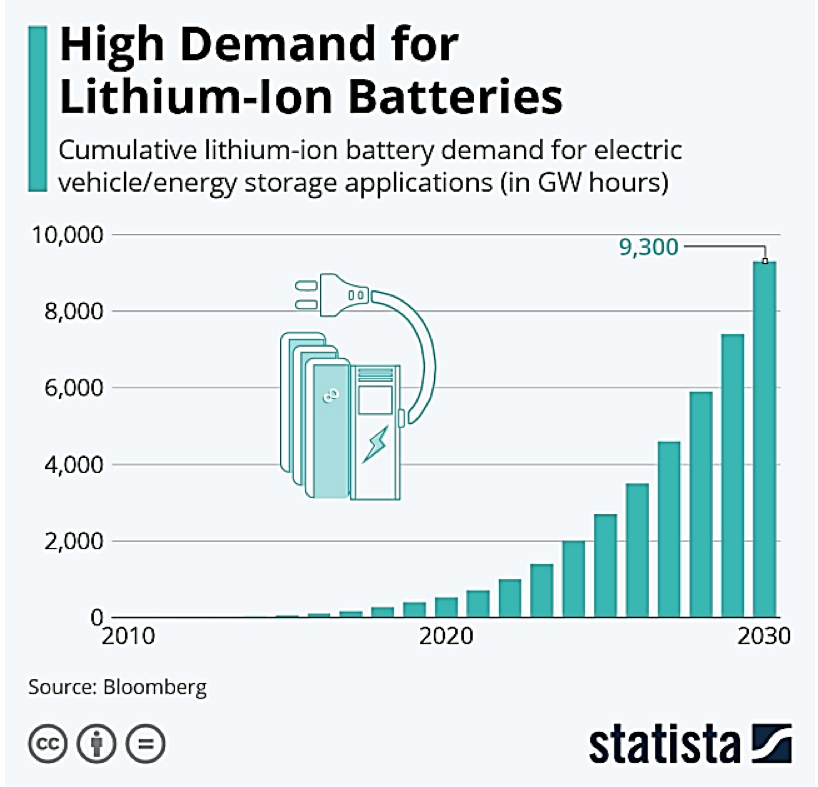

Based on a report published by Grand View Research, Inc., published in April 2023, the global lithium-ion battery market size is expected to reach US$182.53 billion by 2030. In 2022 report, McKinsey predicted that lithium carbonate equivalent (“LCE”) demand will increase from 500 tonnes in 2021 to between 3-4 million tonnes in 2030. McKinsey further states “In 2020, slightly above 0.41 million metric tons of LCE were produced; in 2021, production exceeded 0.54 million metric tons...”

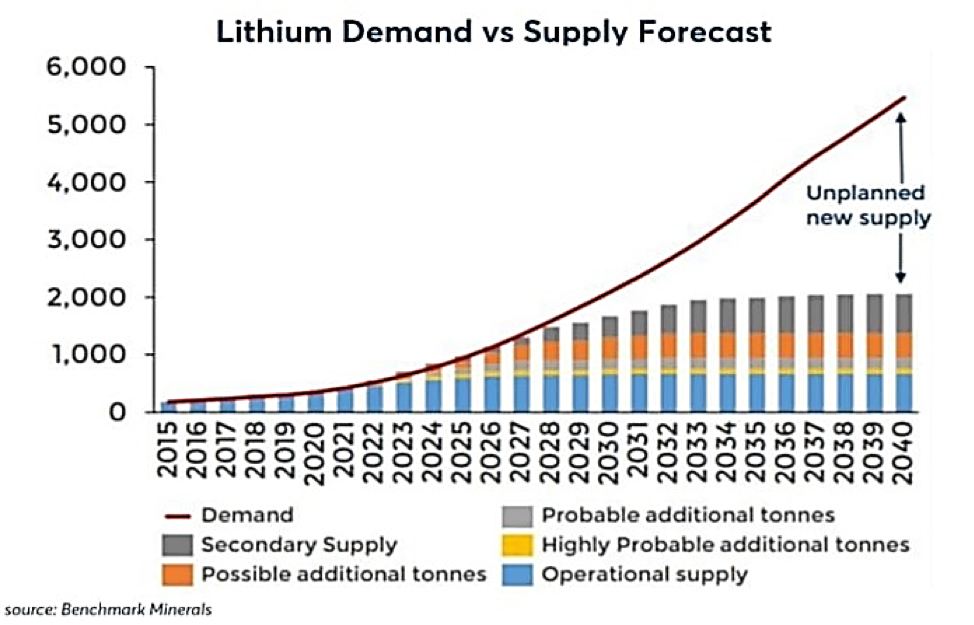

Based on these reports there will be a substantial gap between current supply and expected demand that will need to be satisfied.

Battery-grade lithium is now expected to almost triple by 2025 to more than 850 thousand metric tonnes, and to exceed 1.0Mt LCE in 2027, with growth in excess of 18% per year to 2030. Lithium is the primary component in cell batteries and are central in many consumer electronics goods. Major manufacturers in the primary battery market include Hitachi Maxell, Ultralife, Energizer, FDK Corporation, Tadiran, Vitzrocell, EVE Energy, Panasonic, SAFT, Varta, Duracell, EnerSys Ltd., Gp Batteries, Excell Battery Co., and Bren-tronics.

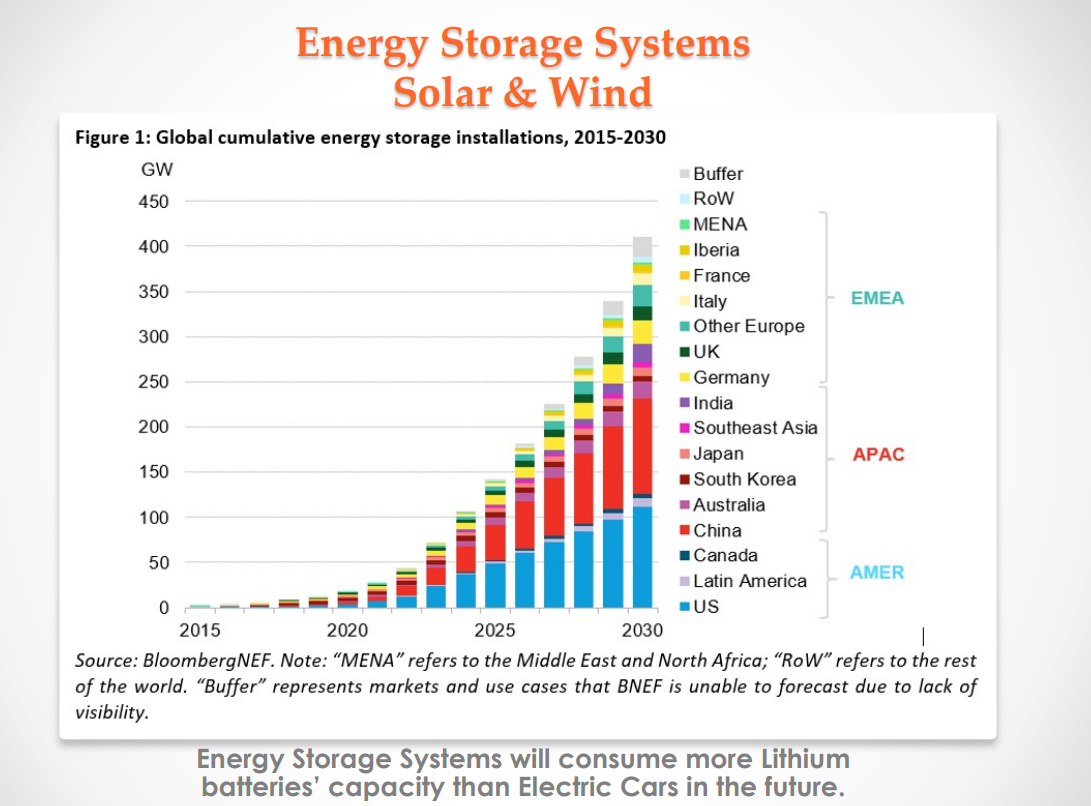

RK Equity’s battery cell forecast is approximately 3,400 GWh in 20301. On its current trajectory, planned capacity could easily reach 8,500-10,000 GWh; however, battery raw material shortages, particularly lithium, will limit the actual volumes achieved in 2030. At battery pack prices of $60-$75/kWh, Li-ion batteries are economically competitive for all storage applications.

Rising demand for and production of Li-ion batteries is leading to the emergence of major battery cell suppliers, including LG Chem, SK Innovation, CALT and Panasonic, along with startup EV battery players like Northvolt, Farasis, SVOLT and many more across the supply chain. At the same time, OEMs are diversifying their suppliers and ramping up production of Li-ion batteries, including Volkswagen Group, General Motors, Stellantis and Ford looking to the Tesla and Panasonic model of joint venture Li-ion battery production – or even looking to in-house lithium mining and gigafactory operations.2

Benchmark Minerals is aware of 40 lithium mines that have been in operation — producing lithium — in 2022. By 2050, Benchmark sees a need for 234 more lithium mines if there’s no battery recycling underway. While much emphasis is put on the as the electric vehicle demand as the driver for the lithium market, Benchmark Mineral Intelligence actually puts stationary energy storage demand by that time — ⅔ of the 11.2 million tonnes expected to be produced each year by then, it has concluded that the lithium market needs to scale up to 25 times or more of the 2021 level by 2050.

Financial Times reported in November 2023, that long-term critical mineral projections modelling demonstrated that basic macro drivers in the battery metals space will continue, and that ongoing structural short supply of critical minerals can not occur in any way. All forecasts continue to highlight that lithium, will indeed be in a deficit for years to come, and Foremost Lithium’s continued exploration is vital to supply the need for this precious commodity.

1 - https://rkequity.com/assets/articles/rh/2021/Frontier%20Lithium%20Report.pdf

2 - https://www.automotivemanufacturingsolutions.com/ev-battery-production/electric-vehicle-battery-supply-chain-analysis-2021-how-lithium-ion-battery-demand-and-production-are-reshaping-the-automotive-industry/41938.article