Properties

GRASS RIVER LITHIUM PROJECT

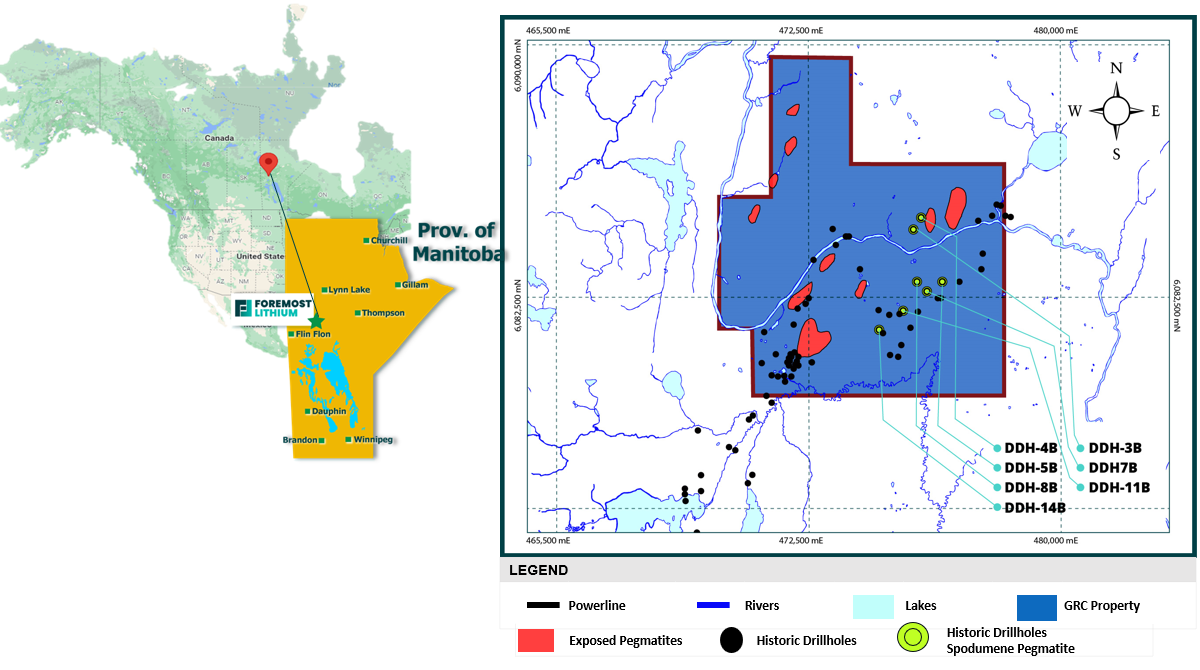

The Grass River Claims Project (“GRC”) consists of 29 claims totaling 15,664 acres/6,339 hectares located 30 km east of the historic town of Snow Lake and 6.5 kilometers east of the Company’s Zoro Lithium Project. The GRC hosts 10 pegmatites exposed in outcrop and 7 drill-indicated spodumene-bearing pegmatite dykes (Figure 1). The Property was acquired by on the ground staking after a review of the geological characteristics of the property. The claims were registered with the Manitoba Mining Recorder in the name of Foremost Lithium on January 18, 2022. (The property originally consisted of 27 claims and 14,873 acres/6,019 hectares.)

Figure 1. Compilation of pegmatites exposed in surface outcrop2 and drill intersected spodumene-bearing pegmatite1 on the Grass River Lithium Property, Snow Lake area, Manitoba

The bulk of mineral exploration in the Snow Lake area was undertaken in the late 1950’s and was primarily designed to assess the general area for base metal massive sulphide mineralization. Ground geophysical surveys (electromagnetics and magnetics) were the primary tool coupled with boots on the ground prospecting. Many holes were drilled to assess base metal environments. During the drilling of geophysical targets, several spodumene pegmatites were intersected1.

COMPANY DEVELOPMENT & PLANS

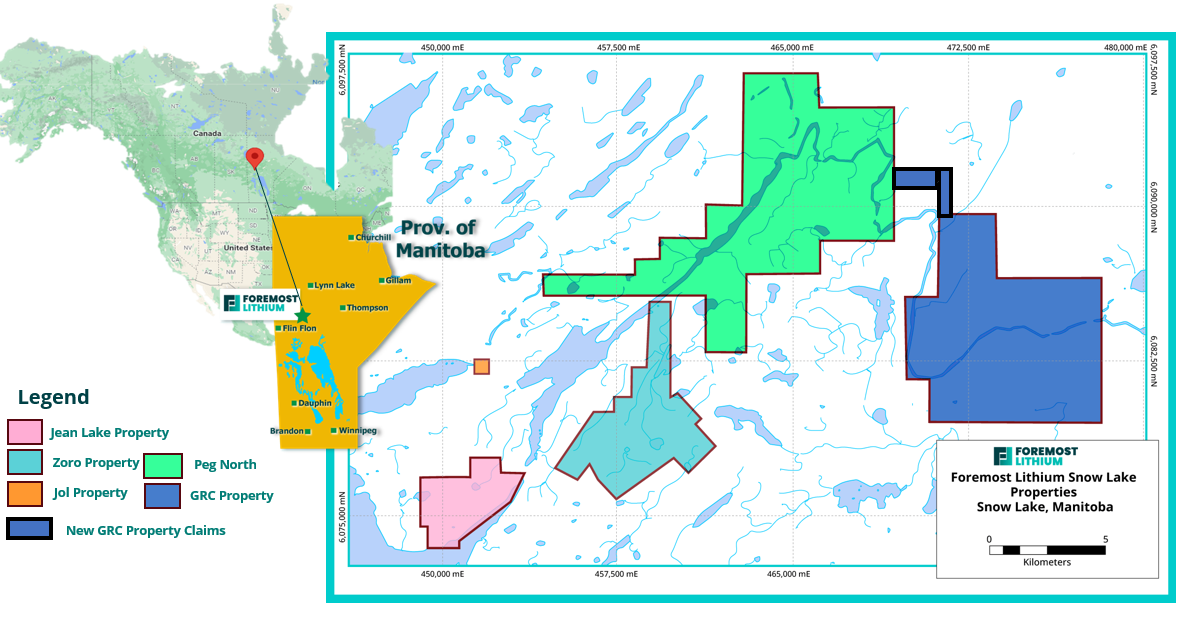

On April 03, 2023, the Company announced that an additional 2 claims (MB 14699 and MB 14700) were staked to increase the number of claims from 27 to 29and the total property area by 790 acres/320 hectares. The two new claims provide linkage between the Peg North Lithium Property and Grass River Claims (Figure 2) thereby allowing the application of assessment credits earned from exploration on either property applicable to both.

Figure 2. Illustrates the newly staked GRC claims outlined in black

Foremost Lithium continues to focus on exploration into 2023. A total of 10 underexplored pegmatites are exposed in surface outcrop and together with the 7 drill-indicated spodumene-bearing dykes will be part of the exploration focus. EarthEx Geophysical Solutions Inc. was contracted to perform a drone-assisted magnetic and Lidar survey on the property applying new technology to produce high-resolution images. The survey will aid in the 3D definition, location, shape, size, and distribution of potential spodumene rich pegmatite dykes. The surveys were undertaken between April 14 and May 27, 2022, and totalled 2,734.1-line km.

Interpretation of results from the magnetic and LiDAR survey helped to define numerous discontinuities in the magnetic fabric. These discontinuities are interpreted to reflect geological structures with the potential to provide pathways for lithium-bearing pegmatite and other styles of mineralization. The surveys will focus follow-up prospecting and geochemical surveys for prospecting in 2023.

Exploration on this property leading to discovery will supplement the drone surveys and will include:

- First pass prospecting of outcrop areas on the claim block focusing on known pegmatite as well as reviewing the structural and magnetic fabric discontinuities.

- Surficial geochemical surveys including Mobile Metal Ions. MMI Technology is the same soil geochemical technology utilized by Foremost on the Zoro lithium property to delineate new drill targets which led to the discovery of high-grade spodumene-bearing Dyke 8

- A drill program to test targets based on integrated datasets.

QP STATEMENT

Technical information relating to information contained on this property’s page has been approved by Mark Fedikow, P. Geo, who is a "Qualified Person" within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Data Sources

1: Cancelled Assessment File 90611, Manitoba Mining Recorder, Manitoba Natural Resources and Northern Development

2: Bailes, A.H. 1985: Geology of the Saw Lake area, Geological Report GR83-2, 47 pages and Map GR83-2-1.